Executive summary

The global energy transition demands clean, abundant, and reliable alternatives to fossil fuels. Geothermal power — the heat of the earth — meets these criteria. Yet its widespread adoption has been hindered by technical and financial barriers, particularly in accessing geothermal resources deep within the earth.

In February 2014, the Department of Energy (DOE) announced a plan to create an unusual new institution, called the Frontier Observatory for Research in Geothermal Energy (FORGE). FORGE is a $218 million field laboratory to conduct hands-on research into “enhanced geothermal systems,” or EGS, a promising form of geothermal power. Using advanced drilling techniques from the shale industry, EGS engineers create underground fractures where water, pumped down from the surface, can gather heat before being drawn back up.

Despite its promise, EGS has yet to achieve broad commercial viability. High initial costs and technical challenges have historically deterred private sector investment, leaving geothermal underfunded compared to other next-generation energy technologies.

FORGE was designed to mitigate the challenges of geothermal by de-risking research and attracting private capital. By providing a publicly funded research environment, the initiative has enabled high-risk experimentation and open-access knowledge sharing. This approach mirrors successful government interventions in the American shale revolution, where strategic public investment catalyzed industry-wide transformation.

It is now ten years since FORGE was founded. In October of last year, DOE signed a new agreement with FORGE extending the program for four years with at least $80 million in additional funding. That means that the project can continue without plugging and abandoning its wells.

FORGE has demonstrated the effectiveness of government-backed field research in unlocking new energy technologies. Its success suggests that similar de-risking models could be applied to other sectors facing market failures, such as rare earth mineral extraction and space-based manufacturing. Moving forward, expanding the FORGE model could position the US as a global leader in geothermal energy and contribute significantly to achieving clean energy abundance.

IFP’s research into the value of FORGE encompassed interviews with geothermal analysts, academics, engineers, and CEOs.

A problem the market hadn’t solved

The earliest EGS projects date back to the 1970s, but the technique has not reached widespread commercial viability. Given the attractive features of EGS, why wasn’t it already a significant part of global power generation? One obstacle: drilling deep wells is expensive, making experimentation — such as in the use of new tools — very costly. The stimulation process, by which fluid is injected so as to create those fissures, can create tremors. And maintaining a viable geothermal reservoir is challenging, meaning that there is no guarantee of a return on investment.

For these reasons, the geothermal sector has not traditionally enticed investors. Looking back at years of stagnant investment, venture capitalist Andrew Beebe remarked: “Geothermal has been maybe appropriately neglected, because it’s proven to be either too expensive or too small in scale whenever it is found and exploited.” Similar sentiments are easy to find. In 2021, the managing director of an accelerator program for energy-focused startups said that geothermal, in certain places, was “fantastic” — but he was less enthusiastic about funding it. “It’s complicated,” said Audun Abelsnes, managing director of the Equinor & Techstars Energy Accelerator. “It’s a really hazardous environment underground.”

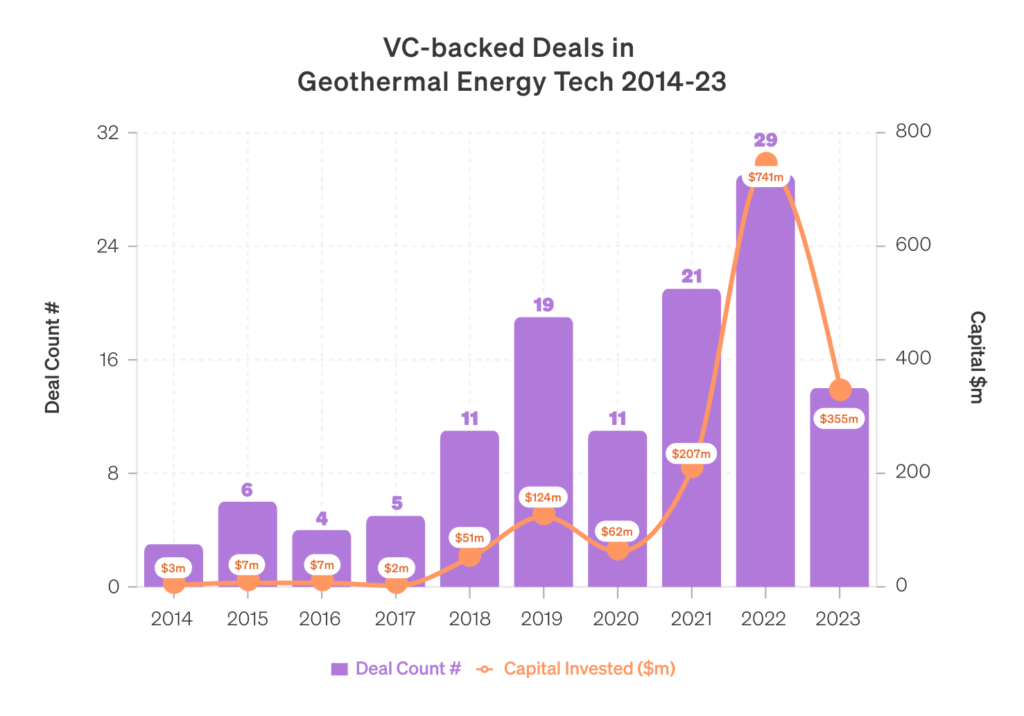

The numbers bear out this pessimism. In the 2010s, venture capital firms invested negligible sums in geothermal. This reticence has been mirrored in government spending. The $218 million cost of the FORGE lab is dwarfed by other investments in next-generation energy technologies: small modular nuclear reactors, carbon management, and hydrogen were given specific appropriations ranging from $3 to 8 billion.

When FORGE was founded, the geothermal industry appeared to require significant investment in order to become viable. Drilling is expensive: it needs heavy machinery, expert labor, and years of uncertainty during which a company navigates the permitting system. The process becomes even more expensive when a company attempts to experiment with methodology, equipment, or choice of subsurface environment. This is principally because of the high cost of failure. If debris blocks the borehole, or if the drill bit goes off-course, or if the surrounding rock formation acquires too many cracks to retain heat, then the wellbore becomes unusable. The drillers must start drilling a new hole.

Progress comes in many forms: efficient modeling of the subsurface, the development of heat-resistant electronics, expertise in drilling through challenging material, and the general dynamic of “learning by doing.” But all of these are costly. In all, return on geothermal investment is slow and uncertain — hardly the stuff of venture capitalist fantasies. It should be no surprise that investors have been reluctant to pile in. Even America’s biggest existing geothermal company, Ormat, told IFP that it lacks the budget for truly substantial R&D.

Bottlenecks of this variety require at least one deep-pocketed actor to turn a large amount of capital into technical and methodological progress. The sector needed what Keynes called “crowding-in”: an increase in private investment stimulated by government investment. This is what happened in the shale oil industry, which is now a key contributor to American prosperity and energy security. As Arnab Datta and Skanda Amarnath have argued, “key policy choices facilitated and accelerated the shale revolution, culminating in a production and productivity boom we are still experiencing today.” These key policy choices included the underwriting by DOE of the cost of drilling wells.

The theory behind FORGE was that it could prompt crowding-in. As DOE said in 2014, “FORGE is a critical step towards creating a commercial pathway to EGS within an aggressive timeframe.” One advantage of the government-backed model is that it enables innovations to be freely shared, rather than protected as intellectual property. The hope, therefore, was that FORGE could bear the costs that would enable a neglected industry to turn into a thriving one.

FORGE’s background and mission

The first stage of the FORGE project was the selection of a site. Geothermal operations are complex, with their viability depending on subsurface geology that takes time, and significant fieldwork, to model. Five sites were considered by the Department of Energy (DOE)’s Geothermal Technologies Office (GTO). The sites were in California, Idaho, Nevada, Oregon and Utah, and each site was examined over a two-year period.

In 2018, the Utah site was judged to be the most appropriate location for the FORGE lab. The site is near Milford, a city in Beaver County, and sits atop fractured Tertiary granitoid rocks. (This means that the bedrock was once magma, formed many millions of years ago, and, usefully, has cracks in it.) The Utah site includes accessible water that is not used for drinking or agriculture, minimizing the risk of drinking water being contaminated by chemicals. It also benefits from nearby transmission lines, and a populace used to local fracking projects. Also, there were no endangered local flora and fauna to disturb.

The project is led by the University of Utah’s Energy and Geoscience Institute. Its $218 million budget lasted through mid-2024. Half of that is spent supporting external R&D projects, and half on the creation and maintenance of EGS systems at the Utah site. (You can take a virtual tour of FORGE Utah here.) The remit for the on-site work includes:

- Innovative drilling techniques

- Reservoir stimulation techniques

- Well connectivity and flow-testing efforts

- Other related activities.

FORGE had a small team: eight full-time equivalents, led by the University of Utah’s Dr. Joseph Moore, working in partnership with private enterprise. Its work would include the testing of equipment sent by private companies. “Fantastic, right?” remarked Dr. Philip Ball, of Geothermal Energy Advisors, in conversation with IFP. “Who else offers you an 8,000-foot hole to put your tool down?” All of its research was open-source and is accessible here.

The field lab’s mission is to spur the private sector into making EGS plentiful and cheap. DOE’s goal is to reduce the cost of EGS by 90%, to $45 per megawatt hour by 2035. (A combined-cycle gas plant comes in at $43 per megawatt-hour.) DOE forecasts that if the EGS sector were to meet this exacting target, it would unlock affordable clean energy for 65 million homes. It would have the additional potential benefit of seeding the use of the technology worldwide.

Has FORGE succeeded?

The success of FORGE can be measured along two dimensions:

- Its technical achievements

- The effect those achievements have had on the industry as a whole.

Let’s first examine FORGE’s technical record. The project’s drilling speeds increased fivefold between 2017 and 2022. Faster drilling means lower costs. This improvement in speed is especially impressive given economic headwinds. Most drills use diesel as fuel, and owing to factors like fuel inflation, the costs from drill-rig service providers have increased significantly. Despite these headwinds, EGS drilling costs have fallen by as much as 50% over the past two years.

Beyond its technical contributions, FORGE was intended to stimulate private sector investment in geothermal energy. Here, the initiative has shown early signs of success. Every geothermal company interviewed by IFP reported that FORGE’s research has directly benefited their operations, even established market leaders like Ormat Technologies. Additionally, land valuations for geothermal-friendly sites in Nevada have risen, reflecting increased market confidence.

Yet industry transformation requires more than just aiding existing players. A critical barometer for FORGE’s impact is whether it has helped to “crowd in” new entrants into the geothermal sector. For evidence of that crowding-in dynamic, see Fervo, a commercial geothermal operation. In selecting the location for its first wells, Fervo chose a plot beside FORGE. The government-backed operation had done the hard work of characterizing the local sub-surface; and now a commercial operation has been able to build on that work.

FORGE has been “extremely valuable” to Fervo, said Jack Norbeck, the company’s CTO. In 2023, Fervo reported the completion of a 30-day well test that set new records for both flow and power output from an enhanced geothermal system. Fervo aims to be providing 70 megawatts to the grid by 2026, and its Nevada site is already providing electricity to Google’s local data centers. In its Series E funding round, which closed in December 2024, Fervo raised $255 million. This figure is comfortably larger than the sums brought in by the entire geothermal sector for most of the 2010s. As an external report acknowledges, “recent reports from Fervo’s earliest deployments demonstrated a 300 percent increase in drilling rate in the process resulting in drilling costs decreasing from an initial of $9.5 million to $4.8 million over six wells in 6 months.”

However, while promising, Fervo’s progress underscores the challenges that remain. The company currently sells electricity at $100 per megawatt-hour, well above the DOE’s $45 per megawatt-hour target for EGS. While EGS costs have been cut substantially, sustained long-term performance at scale remains unproven.

Industry and investor response

The ripple effects of FORGE’s research extend beyond its immediate technological contributions. Investors, once skeptical of geothermal energy, are showing renewed interest in the sector. Notably:

- BP and Chevron have both invested in Eavor, a firm specializing in closed-loop geothermal systems.

- Chevron New Energies has partnered with a venture capital firm to fund geothermal projects across the US.

- Prominent venture capitalist Vinod Khosla has expressed strong optimism, predicting that by the 2040s, “every coal and natural gas plant in the U.S. will be replaced by either fusion or geothermal.”

- Ormat Technologies, a geothermal firm, has reportedly expanded its land holdings around the FORGE site, signaling confidence in the research’s long-term value.

While it would be premature to attribute all of this momentum solely to FORGE, the initiative has undeniably played a role in rekindling industry interest. The once-niche EGS market, valued at $2 billion globally in 2022, is now projected to reach $3.3 billion by 2032. FORGE’s research has become an indispensable resource for both new entrants like Fervo and established players like Ormat.

In short, FORGE has been a hub that combines academic expertise with commercial kit. Because it is judged on scientific progress rather than year-to-year revenue, it has been able to conduct experiments that have risked the blocking of wells. Crucially, it has shared its findings along the way. Fervo is unlikely to be the last geothermal startup that significantly benefits from this groundwork.

Fervo’s drilling rig, on a plot adjacent to FORGE

Criticisms of FORGE

In an ambitious project, it is to be expected that some technologies and experiments will not work. Failures of direction, though, are less desirable. Half of FORGE’s budget must be spent on grantmaking to academic projects that are of less practical benefit than on-site experimentation.

Some in the industry also believe that FORGE is wrong to focus on EGS. For instance, closed-loop systems show promise, but FORGE is wedded to the two-well EGS method. “We would like to see them be a little bit more technology-agnostic,” one CEO told IFP. Closed-loop systems that exist elsewhere in the world have benefited from government subsidies, so we should not assume they are inherently better than EGS.

Other criticisms of FORGE referred to its slowness. It takes too long for the University of Utah to dole out its grants, turning timelines from weeks into years.

An industry expert told IFP that it took too long for FORGE to prepare for a successful circulation test that took place earlier this year. Responding to the criticism of the speed of grantmaking, Dr. Moore said that FORGE must follow the procedures and approvals required by DOE, the State of Utah and the University of Utah in order to guarantee proper accountability of taxpayer funds. “This process takes time and is difficult to streamline. Utah FORGE has worked as fast as it can to issue grants.”

As for the circulation test, Dr. Moore referred to several speedbumps. For instance, the plans were dependent on environmental and archeological surveys. Additionally, state and federal agencies must subsequently approve the findings of those surveys before work can begin. And the delivery of equipment, he added, can take weeks.

What is the overall value of FORGE?

The unanimous verdict of experts IFP spoke to was that FORGE has been successful in its bringing down of drilling times and cost, and useful in its research output. This was the assessment even from geothermal startups using a methodology other than EGS. Every serious player in American geothermal uses FORGE research, and at least one geothermal startup – FORGE’s neighbor, Fervo – owes much of its success to the hard yards already run by Dr. Moore and his team.

The criticisms about speed are less profound than the questions about FORGE’s direction. As things stand, financial necessity limits FORGE’s options, both technically and geologically. It is wedded to the two-well EGS method, and it is confined to a single geological area. Its work is therefore only partly applicable to different parts of the USA, which limits the extent to which industry can capitalize on it. Just as everyone IFP interviewed agreed FORGE had made valuable contributions to the industry, so did they agree that the industry would benefit from similar examinations of different geologies.

Characteristics of FORGE

How has such a small team made this impact? Its budget is a fraction of what is disbursed to more glamorous energy initiatives, such as the $1 billion DOE requested for its fusion program.

One explanation is that EGS remains relatively underexplored, allowing FORGE to capitalize on low-hanging fruit. When it was founded, it was the only dedicated EGS research facility in the world. Under these conditions, significant progress was almost inevitable. However, FORGE’s effectiveness is also attributable to its clear and focused mission: to make EGS commercially viable. Its leadership has maintained consistent priorities, particularly in drilling cost reduction, which has driven meaningful advancements.

Beyond leadership, FORGE benefits from a team with deep expertise across disciplines, including conventional and EGS geothermal systems, drilling, rock mechanics, reservoir engineering, hydraulic stimulation, and seismic analysis. Another often-overlooked factor in FORGE’s success is its strong relationships with key stakeholders. By maintaining good relations with local communities, state and federal agencies, and industry partners, FORGE has avoided many of the regulatory and social hurdles that can stall energy projects.

Importantly, FORGE’s leadership has been willing to tolerate the risk of failure. A FORGE collaborator interviewed by IFP singled out Dr. John McLennan, the project’s co-principal investigator, for praise. “I thought he was fantastic… Failure wasn’t failure, because failure meant you were learning something.”

FORGE has not had to demonstrate profitability to investors. As a result, it has been able to plan research on longer timescales. FORGE’s central and non-commercial role within the geothermal sector has allowed it to pool the industry’s expertise.

It is also worth exploring the reasons why FORGE has made technical progress. In some cases, the advances were enabled by FORGE’s unique status as a lab that bridges industry and academia. FORGE makes all of its research publicly and freely available, which means that commercial players can easily benefit.

The improvement in drilling economy comes down to several factors. One of the most important was FORGE’s piloting of what is now an industry-leading drill bit, the polycrystalline diamond compact (PDC) bit. It was imported from the oil and gas sector after decades of use there. Thanks to its artificial diamond coating, the bit is able to cut through hard rock more efficiently than its predecessor. This means faster drilling and less swapping out of mangled drill bits. The switching of drill bits was previously an enormous waste of time for engineers drilling deep wells.

Another important factor was FORGE scientists’ smart use of data to inform their drilling. For instance, a visiting team deduced that their obstructed drilling progress was a result not of the hardness of the granite, but a clog created by drilling mud. They flushed out the clog with a 100-gallon water “pill.” This halved the bit’s energy consumption and doubled its drilling rate. FORGE has consistently completed its drilling projects ahead of time and under budget.

Other FORGE achievements include:

- The pioneering use of fiber-optic cables for high-quality monitoring of underground temperature and seismicity.

- The testing, in partnership with manufacturers, of commercial equipment such as an industry-leading petroquip plug. (This is a piece of equipment that seals the wellbore during stimulation.)

- Advances in mechanical-specific energy monitoring. (This is the monitoring of the drill string to ensure energy is going into drilling rather than wrecking the string.)

- Various improvements in reservoir management, such as the control of injected fluid and of seismicity.

- The testing of equipment at 200°C (392°F), which is important because:

- High temperatures mean high energy density

- The oil and gas industry rarely deals with temperatures this high, meaning the geothermal industry has to work things out for itself.

- Being the first drilling project to drill a very deviated (i.e. slanted) well at 200°C. Directional drilling is a method whereby the drill goes in directions other than straight down. It enables more efficient access to underground heat. Elsewhere in the industry, it is helping to enable the creation of radiator-like reservoir systems. This method is known as closed-loop geothermal, and it might end up being better at retaining heat than fractured networks.

Some experiments, however, did not yield positive results. FORGE tested particle drilling, a method that involves propelling high-velocity ball bearings into rock formations, as well as the mud hammer technique, which uses fluid pressure to enhance drilling motion. Both methods proved ineffective.

But these unsuccessful trials should not be held against FORGE. Rather, the lab should be praised for this experimental work. A perfect success rate would indicate a lack of ambition, whereas failure in high-risk experiments suggests that FORGE is fulfilling its role as a cutting-edge research laboratory.

What’s next for FORGE?

Geothermal has made encouraging progress since FORGE was founded. The lab has impressed members of Congress. Via the Energy Act 2020, Congress gave GTO authorization to renew FORGE and establish up to three more FORGE sites. The Department of Energy (DOE) recently approved a four-year extension for FORGE, accompanied by up to $80 million in new funding.

There is much value still to be derived from its existing site, particularly if an extension of funding allows FORGE work to access deeper and hotter parts of the subsurface. FORGE should continue to work with companies trying to make heat-resistant equipment. It should step up that work, encouraging those companies, whether they are based in the US or abroad, to try their kit in the field.

Rightly, the goal of FORGE is to spur commercial activity. The project should not go on indefinitely. But the progress of Fervo should not be confused with the completion of FORGE’s mission. The principal challenge of geothermal is not the extraction of hot water; it is extracting hot water over a period of several years. Many past projects have suffered from thermal drawdown, where reservoirs cool prematurely, reducing their effectiveness for sustained energy production. Addressing this issue is essential for securing investor confidence and proving the long-term economic viability of EGS.

Additionally, commercial viability is not a binary achievement. The first successful EGS project will not necessarily reflect the full potential of engineered geothermal reservoirs or the maximum depths and temperatures that can be reached. At the current stage in geothermal’s evolution, there is much that a government-backed field lab can offer.

A more ambitious iteration of FORGE could devote additional resources to high-temperature drilling technology. The ability to operate at extreme depths and temperatures is pivotal; deep rock formations contain supercritical fluids, which hold an energy density comparable to natural gas. Successfully harnessing these resources could shift geothermal energy from a niche contributor to a dominant source of U.S. baseload power.

FORGE is already working at temperatures of 220℃, the point at which electronics that are needed at the bottom of a hole quickly break. The team is working with companies to improve the durability of those electronics. But advocates of supercritical geothermal, as the field is known, want FORGE to go all-in on this endeavor.

Many in the industry view the quest for superhot rock as unrealistic, but the Iceland Deep Drilling Project has reached magma of 900-1,000℃. The Icelandic engineers have not solved the problems of broken electronics and melted well casing, but their work shows an ambition that American research and development should be matching or exceeding. In this spirit, DOE has already given funding to superhot rock projects. Additionally, two Congress representatives recently put forward legislation that would require that “at least one FORGE site has the capabilities to include supercritical testing and, if practically and technically feasible, closed-loop geothermal systems.”

FORGE should actively solicit closed-loop geothermal research, expanding its scope beyond EGS. Closed-loop geothermal has the advantage of not requiring reservoir stimulation, reducing seismic risks and making it more attractive for urban deployment. This approach also has potential applications in district heating, providing direct heat to urban water systems and phasing out natural gas boilers.

While continuing to refine EGS methodologies, FORGE must now focus on addressing the thermal drawdown problem. If current EGS startups fail to sustain long-term heat extraction, it should not signal the end of American geothermal innovation — but rather an opportunity for further advancements in reservoir management and heat recovery.

New FORGEs

For its freely-available research, and for its ability to test equipment and methodology on behalf of the private sector, FORGE remains the US government’s best-value lever for improving the industry’s prospects. That lever must be retained.

It should also be duplicated — several times. As several experts have told IFP, it is likely that more FORGEs, located in different geologies and geodynamic environments, would pay for themselves by unlocking region-specific private enterprise. A key hurdle for startups remains the difficulty of characterizing a new subsurface. But new FORGEs can do what Utah FORGE has done in Beaver County, making it easy for new players to move in. These new FORGEs could expand the project’s methodological remit, encompassing EGS, closed-loop, supercritical and water heating. (In theory, it might make sense to explore even more geologies, but a total of three new labs would be commensurate with the scale of the existing industry.) These formats, like EGS when FORGE was founded, are promising but immature.

Federal support should spur industries rather than reduce investors’ outgoings. If it can be calibrated in this manner, it will enable investigation of these promising new formats.

The additional trio of FORGEs could be located in:

- Washington or Oregon, where much of the bedrock is basalt rather than granite.

- Northeastern USA. Here, a very low heat coefficient would make EGS more challenging, though still worth mastering.

- California. The state’s tectonic faults contain extensive fracture networks. This quality, as well as local areas of high heat flow, makes California another promising area for exploration.

Texas, too, is a promising location. There is hot bedrock beneath its major cities, and plenty of local expertise in extracting resources from the subsurface. (One Texan startup has already accessed the hot stone beneath a well abandoned by Shell).

FORGE’s location is marked by the star. Note the other parts of the USA with hot rock close to the surface. Source: https://utahforge.com/about-us/

Realistically, the outcome of the current funding negotiations will not be a multiplication of FORGE’s budget. But these new FORGEs would not need the same amount of funding as the Utah iteration, which could remain the workhorse of the wider FORGE operation. Still, they could be used to share the load of the experimentation with closed-loop and supercritical geothermal. Fortunately, the groundwork for the selection of the Utah site involved extensive work on those other three potential sites. The work extended to both permitting and the modeling of the subsurface. Those three sites would be good starting points in the search for new FORGE locations.

If each new site costs half that of Utah FORGE, that would make for an additional spend of $330m. This is hardly a trivial commitment, but it is a fraction of the DOE’s existing $161bn budget. If the new FORGEs were to catalyze more copycat startups, and if some of those startups begin to reliably supply baseload power, then the expanded budget will look like a sound investment. It might also have the more diffuse benefit of catalyzing similar activity elsewhere in the world.

Should the government go on a pro-geothermal tear, it must also lower the bureaucratic barriers that currently obstruct geothermal. In other reports, IFP highlights several of them. It is no good creating a new power station, a CEO told IFP while discussing FORGE, if it takes up to four years to connect it to the grid.

Applying the FORGE model elsewhere

FORGE is conducting the crucial early-stage work necessary to solve a problem that the private sector had not yet addressed. By openly sharing its research and providing a testing ground for industry innovations, it is lowering barriers to entry for geothermal startups and advancing technologies that could unlock the sector’s potential. This approach, which reduces risk for private firms, aligns with the Department of Energy’s (DOE) broader goal of catalyzing commercial investment in geothermal energy. The success of Fervo Energy may be an early indication that FORGE is achieving its mission of “crowding-in” private capital.

Could this de-risking model be applied to other industries? The appeal of government-funded research is clear: it allows private firms to bypass costly R&D expenses. However, caution is warranted in treating this model as a one-size-fits-all solution. Public sector intervention is most effective when addressing market failures — where industries lack the economic incentives to invest in foundational research on their own.

In the shale revolution, early-stage government support paved the way for private sector breakthroughs. The same model applies to geothermal: the government digs the first few feet, then hands over the shovel.